Thank you to our Chamber Sponsors

INTERESTED IN HAVING YOUR BUSINESS

FEATURED HERE AS A SPONSOR?

Give us a call

for all the details.

2024 Gold Sponsors

None, yet... be the first Gold sponsor! Call now!

2024 Silver Sponsors

2024 Bronze Sponsors

None, yet... be the first Bronze sponsor! Call now!

Upcoming General Events — Mark Your Calendar and Register

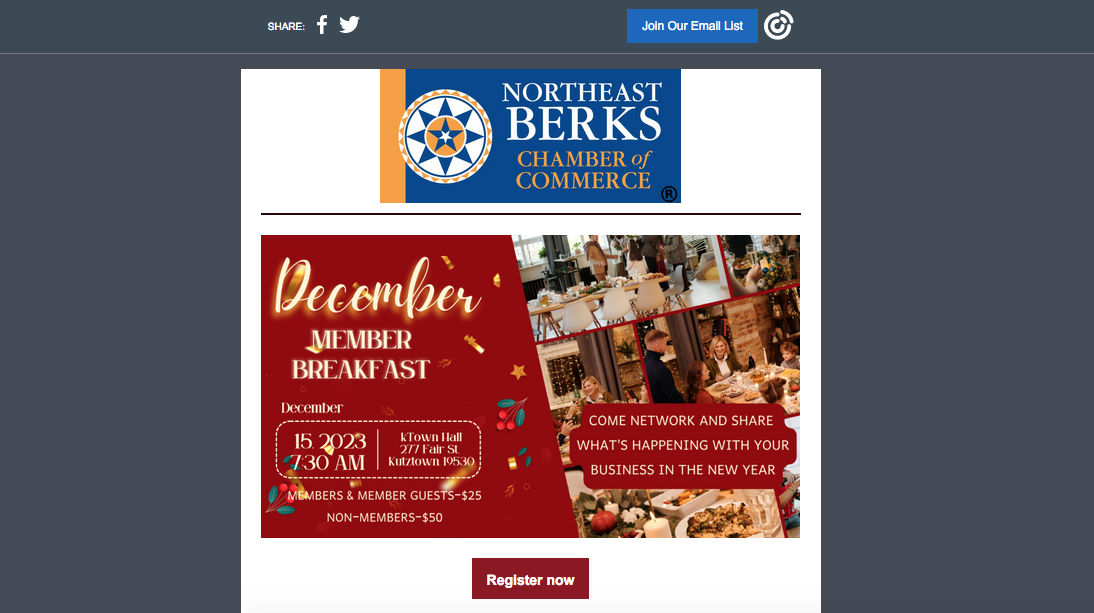

Monthly Member Breakfast

Fri Sep 20 2024Monthly Member Breakfast

Fri Oct 18 2024Monthly Member Breakfast

Fri Nov 15 2024Monthly Member Breakfast

Fri Dec 20 2024Monthly Member Breakfast

Fri Jan 17 2025

Upcoming Member Events

Let's Get Social - Joint Networking

Wed Aug 14 2024, 05:00pm EDTOley Valley Youth LeagueMonthly Member Breakfast

Fri Sep 20 2024Monthly Member Breakfast

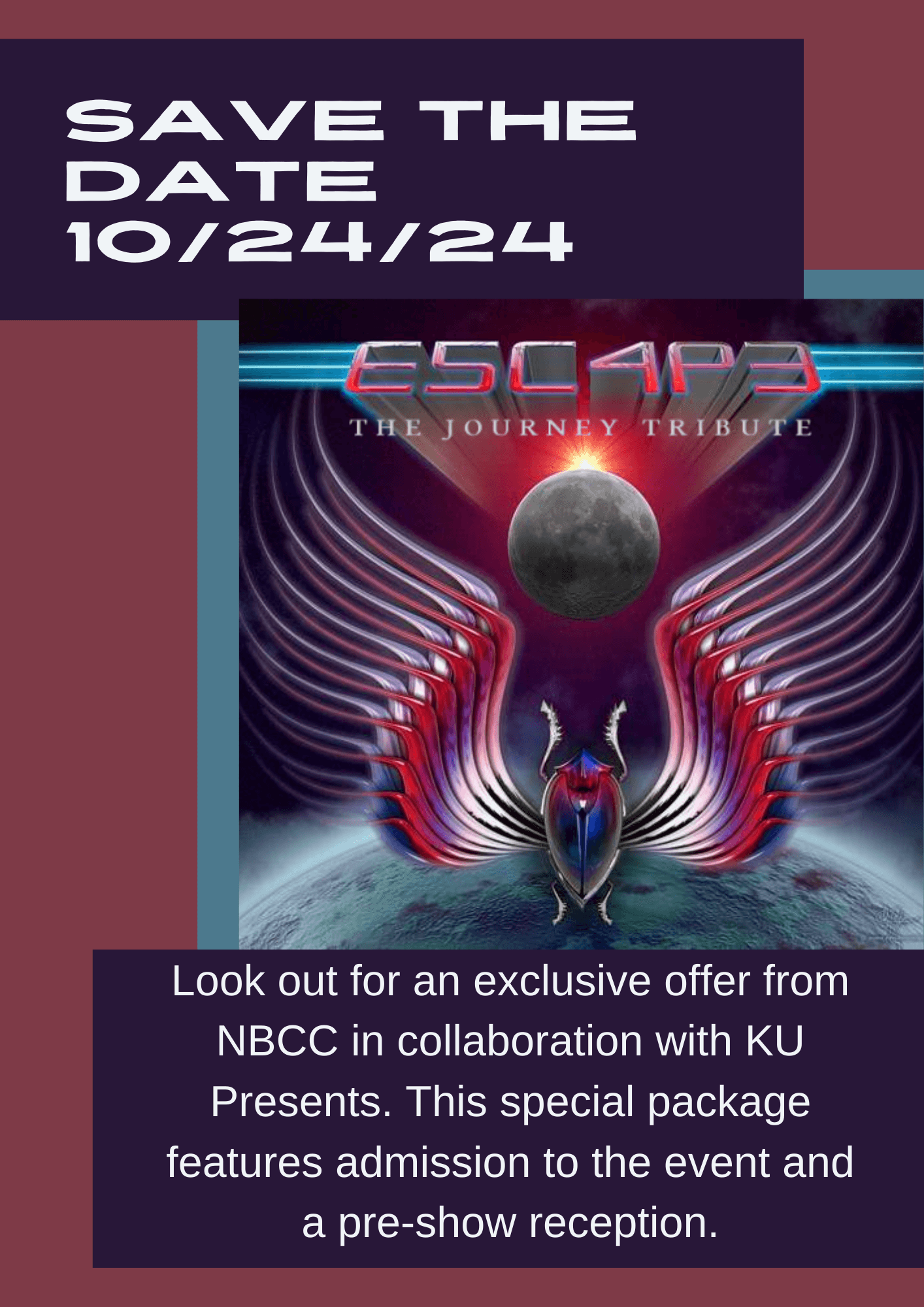

Fri Oct 18 2024ESC4P3: The Journey Tribute

Thu Oct 24 2024Monthly Member Breakfast

Fri Nov 15 2024

Upcoming Meetings

No current events

Join our mailing list to receive weekly news and announcements.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact

WHAT'S HAPPENING ON FACEBOOK...

As you respond to the many challenges of COVID-19 and its impact on your business--whether start-up or established--one in which you have invested all of your energy, we want you to remember…Our history with your business is shaping a new chapter in our partnership. The Chamber, too, must shift and adapt in some of the traditional ways that we have delivered benefits to you over 30 years. The future is always an unknown; our relationship with you is not. That makes the difference.

Your Regional Chamber of Commerce and an Advocate for Your Business since 1989.